Retirement planning is a vital step in ensuring financial stability during your golden years. While it might seem daunting, a well-thought-out strategy can make a significant difference in your retirement lifestyle.

Here are some key pointers to consider as you embark on your retirement planning journey.

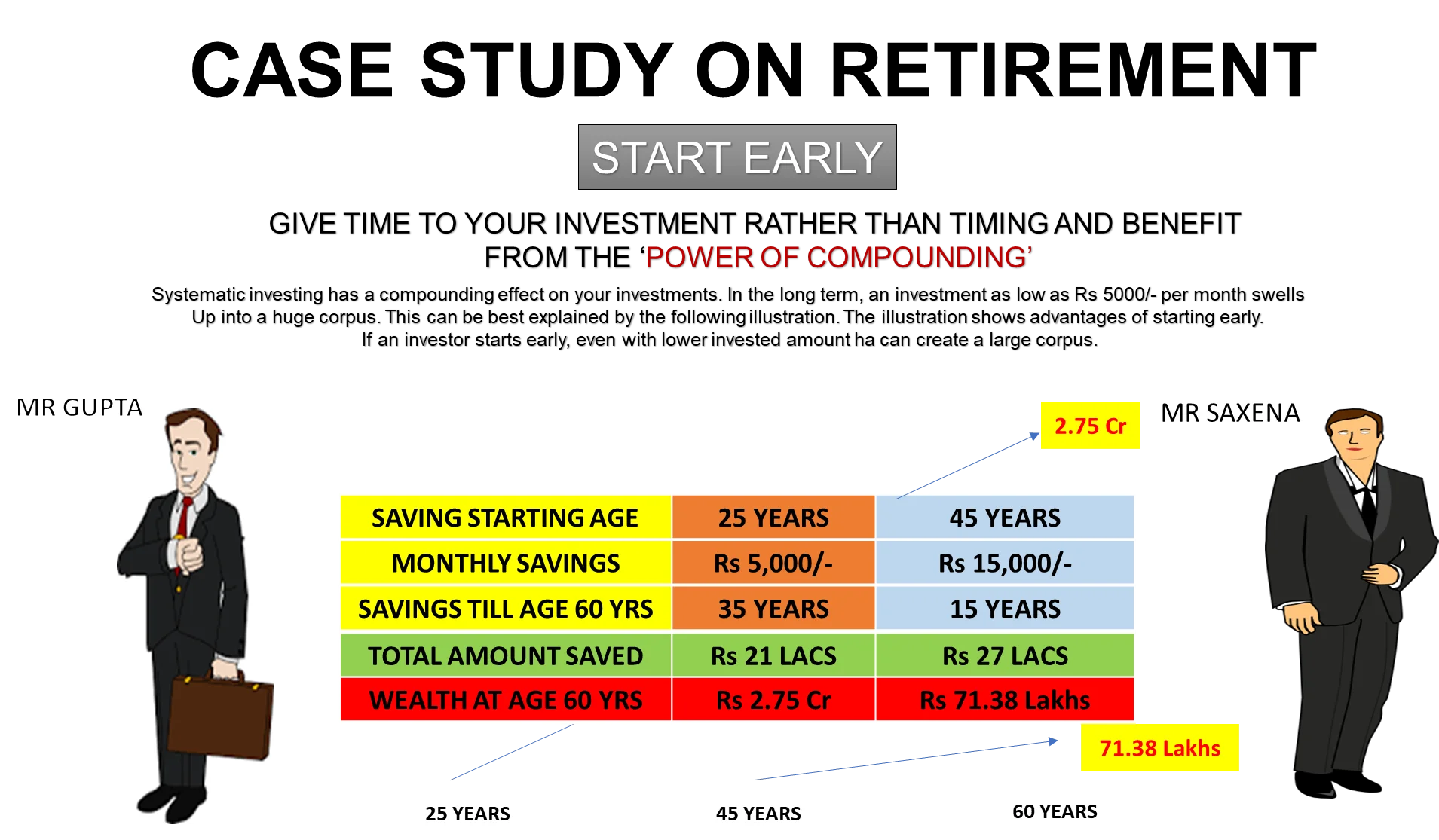

- Start Early: Time is your most valuable asset. The sooner you begin saving for retirement, the more time your money has to grow. Compound interest can work wonders over decades, so don’t procrastinate.

- Set Clear Goals: Determine your desired retirement lifestyle and estimate the expenses you’ll incur. Be sure to account for healthcare, travel, hobbies, and everyday living costs.

- Calculate Retirement Income: Identify all potential sources of income, including pensions, Social Security, investments, and any other assets. This will help you gauge how much you need to save to bridge any gaps.

- Create a Budget: Build a realistic budget that aligns with your retirement goals. This can help you manage your spending and ensure you’re saving enough.

- Diversify Investments: Spread your investments across various assets such as stocks, bonds, and real estate. Diversification reduces risk and enhances your chances of steady growth.

- Contribute to Retirement Accounts: Maximize contributions to retirement accounts like 401(k)s and IRAs. These accounts offer tax advantages and can significantly boost your savings.

- Manage Debt: Strive to pay off high-interest debts before retirement. Reducing financial obligations can ease your post-retirement financial burden.

- Account for Inflation: Inflation erodes purchasing power over time. Consider investments that have historically outpaced inflation to safeguard your retirement funds.

- Regularly Review and Adjust: Life circumstances change, and so should your retirement plan. Regularly review your portfolio and financial goals to make necessary adjustments.

- Healthcare Considerations: Research healthcare options and understand how Medicare works. Medical expenses can be a substantial part of retirement costs.

- Emergency Fund: Maintain an emergency fund for unexpected expenses. This can prevent you from dipping into your retirement savings prematurely.

- Seek Professional Advice: Consulting a financial advisor can provide tailored guidance based on your situation. They can help fine-tune your retirement plan and provide insights you might have missed.

In conclusion, retirement planning demands foresight and discipline. Starting early, setting clear goals, and making informed investment decisions are crucial. Remember that your retirement years should be comfortable and worry-free, and effective planning today can help you achieve that peace of mind in the future.