Tax Consultancy

take look at our

Tax Consultancy Services

What is Tax Planning?

Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon him/her by making maximum use of all available deductions, allowances, exclusions, etc. feasible under law. In other words, it is the analysis of a financial situation from the taxation point of view. The objective behind tax planning is insurance of tax efficiency. Tax planning allows all elements of the financial plan to function in sync to deliver maximum tax efficiency. Put simply, it is an arrangement of an assesses business or financial dealings, in such a way that complete tax benefit can be availed by legitimate means, i.e. making use of all beneficial provisions and relaxations provided in the tax law, so that the incidence of the tax is minimum. This ensures savings of taxes along with conformity to the legal obligations and requirements. Therefore, it is permitted by law. Hence, “Tax Planning” is critical for budgetary efficiency. A reduced tax liability and maximized the ability of retirement plans.

Tax Planning In India

Tax Planning In India Indian law offers a variety of tax saving options for the taxpayers, allowing for a large range of options for exemptions and deductions through which you could limit your overall tax output. Indian law offers a variety of tax saving options for the taxpayers, allowing for a large range of options for exemptions and deductions through which you could limit your overall tax output.

- The deductions are available from Sections 80C to 80U and can be utilised by eligible taxpayers.

- All these deductions happen against quantum of tax liabilities.

- There many other sections under the Income Tax Act, 1961 such as exemptions and tax credits that can lower your tax liabilities.

Objective Of Tax Planning

Minimization of Litigation: There is always friction between the collector and the payer of tax. In such a situation, it is important that the compliance regarding tax payment is followed and used properly so that friction is minimum.

Productive Investment: Among the most important objectives of tax planning is channelization of taxable income to various investment plans.

Reduction of Tax Liability: As a tax payer, you can save the maximum amount from payable tax amount by using a proper arrangement of your enterprise working as per the required laws.

Healthy Growth of Economy: The growth in an economy depends largely upon the growth of its citizens. Tax planning estimates generation of white money that is in free flow.

Economic Stability: Stability is supplemented when the tax planning behind a business is proper.

This is the arrangement of a tax payer’s business or financial dealings, in such a way that complete tax benefit can be availed by legitimate means, so that the amount of the tax is minimal.

Process Of Tax Planning

- All you need to do is to claim the tax benefits is invest in eligible instruments.

- Giving correct information to relevant IT authorities.

- Being well informed of applicable tax laws and court judgements on the same.

- Tax planning should be done completely under the purview of law.

- Planning should take into consideration business objectives and flexibility for the incorporation of future changes.

- You could be a long-time taxpayer or a first-time payer, in case you did not plan your taxes properly, you are probably paying more in tax than you should.

- Income Tax clauses seem so complex that the common man is averse of dealing with taxes.

- This is the arrangement of a tax payer’s business or financial dealings, in such a way that complete tax benefit can be availed by legitimate means, so that the amount of the tax is minimal.

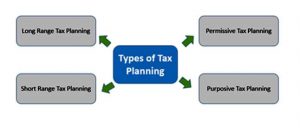

Types Of Tax Planning

- Short-range Tax Planning: The tax planning which is done annually to arrive at specific objectives is called short-range tax planning.

- Long-range Tax Planning: Long-range tax planning does not include immediate pay-offs of any kind.

- Permissive Tax Planning: Here the planning conforms to law provisions of tax.

- Purposive Tax Planning: This is the tax planning method that is based on loopholes in the laws.

Tax planning is a term that stands for calculated application of tax laws, so as to effectively manage a person’s taxation. Leading to avail the tax benefits as per the law and in accordance with the interest of the nation and its people.

Corporate Tax Planning

This is a way of lowering the liabilities on a registered company. One of the most used methods is by including the deductions on business transport, health insurance of employees, etc. With tax deductions and exemptions provided under the Income Tax Act, 1961, your enterprise can largely reduce its tax burden in a legal way.

Rising profits of an enterprise means higher liabilities of tax. In such a situation, it is important that they dedicate enough time on tax planning that reduces liabilities. With a tax plan, both direct tax and indirect tax is lessened at the time of inflation. Not just this. Tax planning means a proper planning of:

- Expenses.

- Capital budget.

- Sales and Marketing costs.

What Mudraguna provides through Tax Planning?

TAX PLANNING & CONSULTANCY SERVICES

Tax planning and consultancy services incorporates

- Analysing the customer’s current financial and tax planning status and prescribing the customers a proper tax planning structure along with various investment opportunities which will help the individuals not only in saving taxes but at the same time generate efficient returns.

- We prioritise ourselves not only in providing various apt investment opportunities but at the same time we focus on saving taxes by prescribing right tax savings investment product and strategy which will help the individuals in saving taxes and generate the amount which is suitable for achieving their desired goals.